15+ paycheck calculator ri

If youre a new employer congratulations by the way you. Calculating your Rhode Island state income tax is similar to the steps we listed on our Federal paycheck.

System Administrator Salary How Much Can You Earn

SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

. So the tax year 2022 will start from July 01 2021 to June 30 2022. For example if an employee earns 1500. Calculate your Rhode Island net pay or take home pay by entering your per-period or annual salary along with the pertinent federal.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Rhode Island. Ad Compare Prices Find the Best Rates for Payroll Services. Your average tax rate is 1198 and your.

Rhode Island Salary Paycheck Calculator. Overview of Rhode Island Taxes. If you make 70000 a year living in the region of Rhode.

This free easy to use payroll calculator will calculate your take home pay. Rhode Island has a progressive state income tax system with three tax brackets. Rhode Island Salary Paycheck Calculator.

The tax rates vary by income level but are the same for all taxpayers. Just enter the wages tax withholdings and other information required. This free easy to use payroll calculator will calculate your take home pay.

Supports hourly salary income and multiple pay. The state income tax rate in Rhode Island is progressive and ranges from 375 to 599 while federal income tax rates range from 10 to 37 depending on your income. Rhode Island Income Tax Calculator 2021.

51 Arm Mortgage Rates. How to calculate annual income. It is not a substitute for the.

This Rhode Island hourly paycheck. Use ADPs Rhode Island Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Rhode Island Paycheck Calculator.

Simply enter their federal and state W-4 information. Employers pay between 099 and 959 on the first 24600 in wages paid to each employee in a calendar year. Make Your Payroll Effortless and Focus on What really Matters.

If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Rhode Island residents only. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

71 Arm Mortgage Rates. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Symmetry Software Offers Dual Scenario Calculators To Aid In Comparing Take Home Pay For Varying Deductions And Benefits

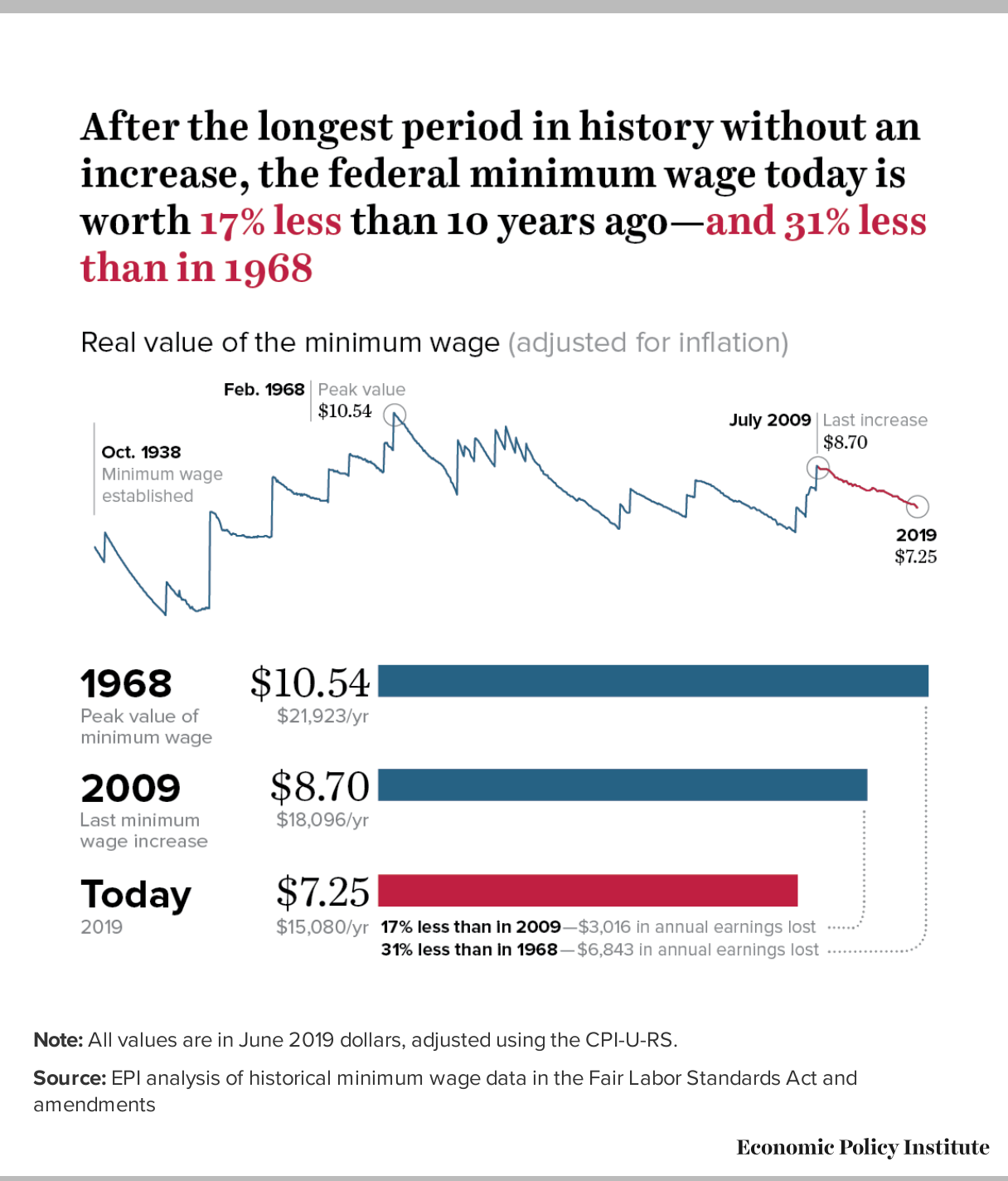

Labor Day 2019 Low Wage Workers Are Suffering From A Decline In The Real Value Of The Federal Minimum Wage Economic Policy Institute

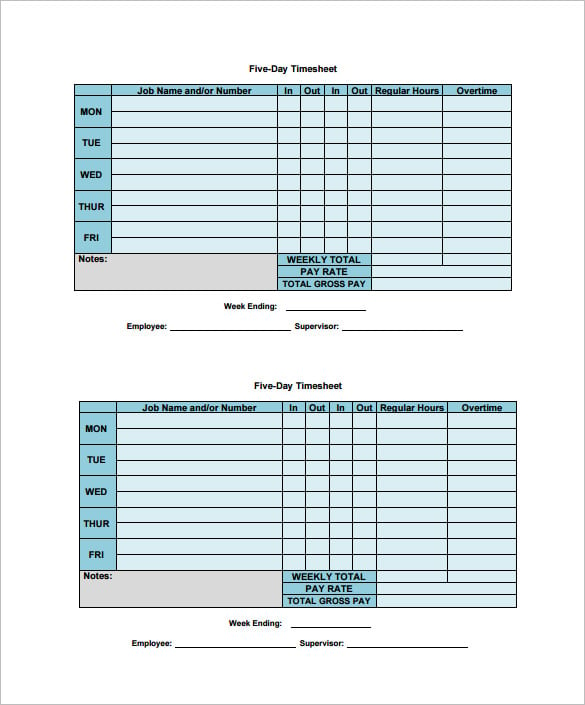

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

80 S Birthday Invitation Digital File You Print Etsy

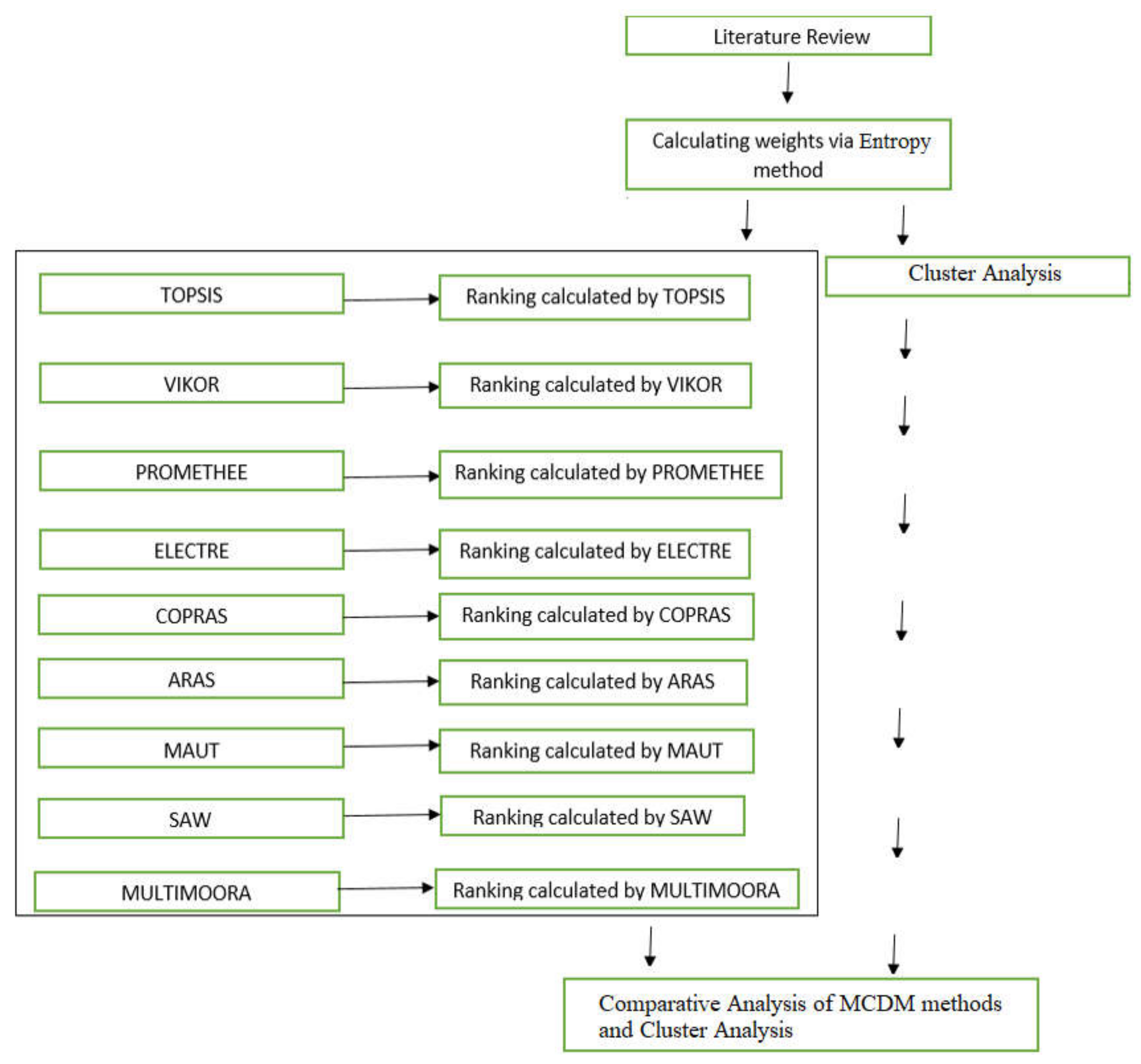

Sustainability Free Full Text Science Technology And Innovation Policy Indicators And Comparisons Of Countries Through A Hybrid Model Of Data Mining And Mcdm Methods Html

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

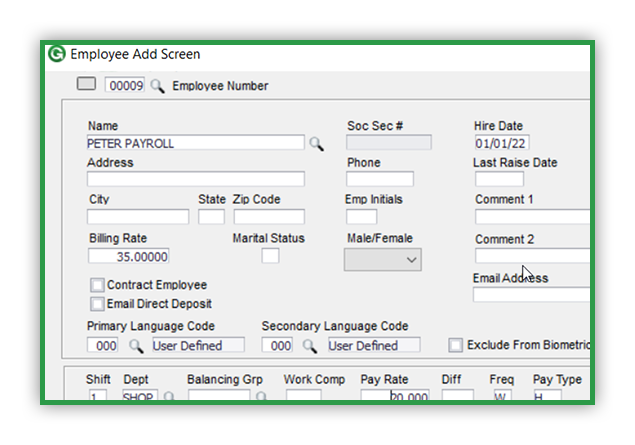

Hr And Payroll Software For Manufacturing Global Shop Solutions

Seer Savings Calculator 13 Vs 14 Vs 15 Vs 16 Vs 18 Seer

Roller Skating Party Favor Tags Set Of 12 Rollerskate Etsy

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Payrollguru Ios Payroll Applications And Free Paycheck Calculators

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Apo Bookkeeping

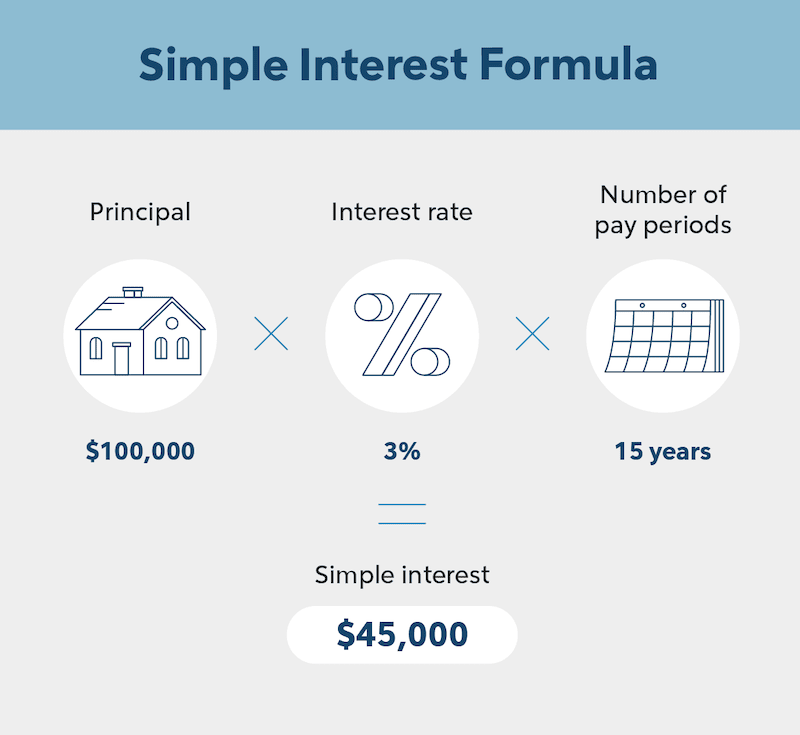

What Is Simple Interest How To Calculate It For Your Home Loan Quicken Loans

Us Paycheck Calculator Queryaide

Free Paycheck Calculator Hourly Salary Usa Dremployee

Rimkus Consulting Group Forensic Engineer Salaries Glassdoor